Navy Federal Credit Union

Information

- Category: Finance

- Price: free

- Age Rating: 14+

- Rating: 3

- Developer: Navy Federal

- Version: 7.2.4

Navy Federal Credit Union is a credit union that serves members of the United States Armed Forces, Department of Defense, and their families. The credit union was founded in 1933 and is headquartered in Vienna, Virginia. It is the largest credit union in the United States by assets and membership, with over $100 billion in assets and over 9 million members. Navy Federal Credit Union offers a range of financial products and services, including checking and savings accounts, loans, credit cards, and investment options. The credit union is known for its competitive rates and personalized service.

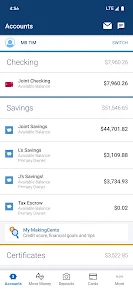

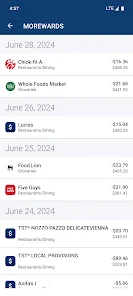

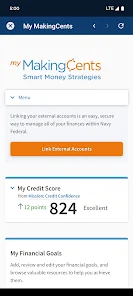

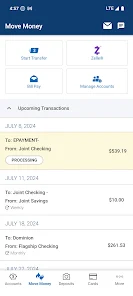

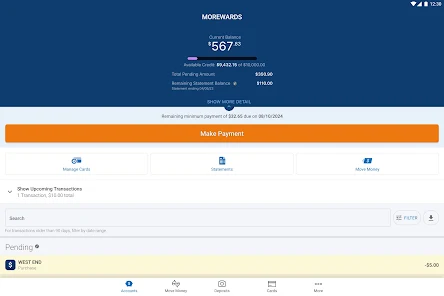

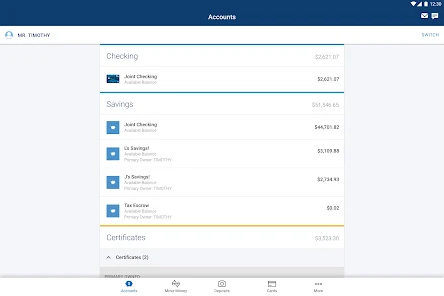

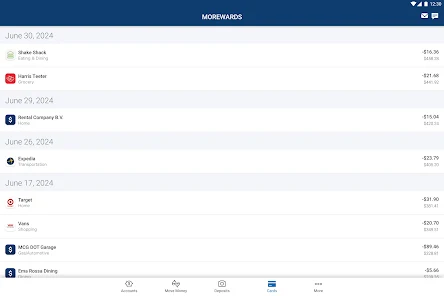

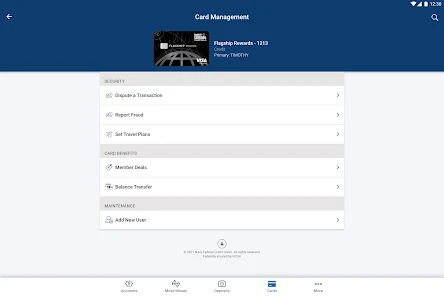

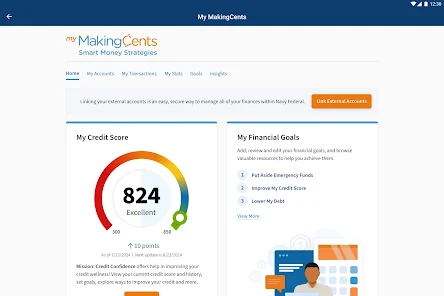

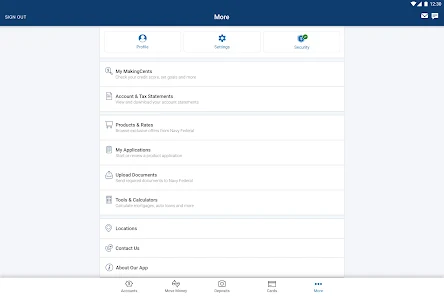

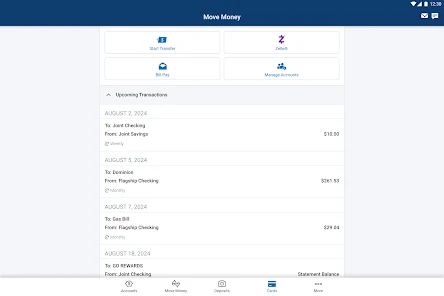

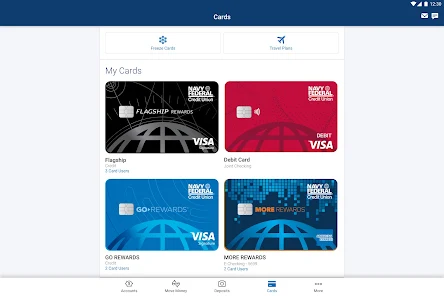

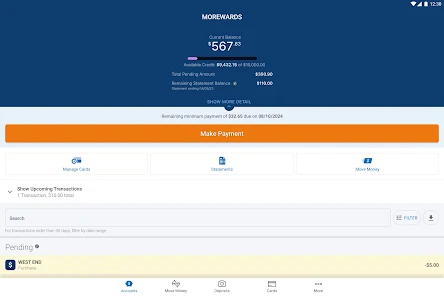

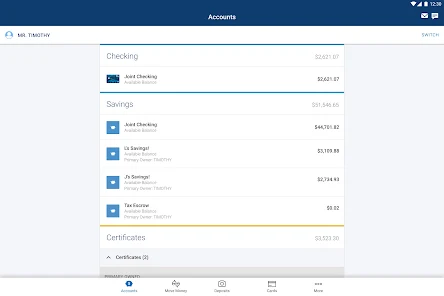

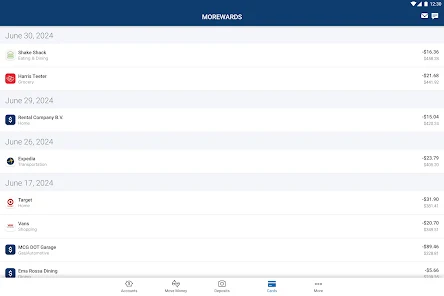

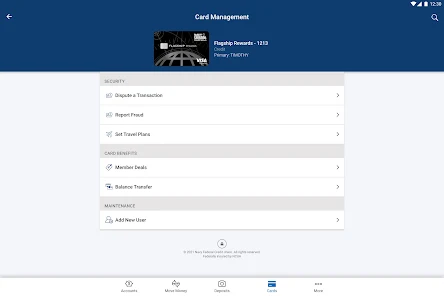

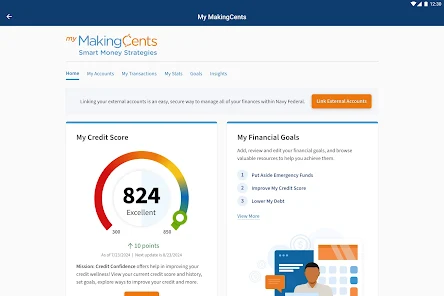

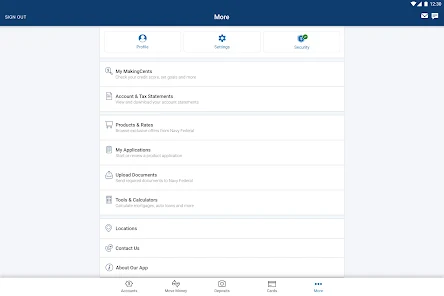

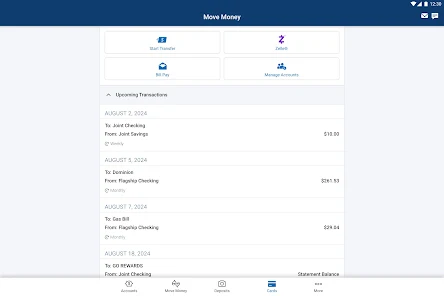

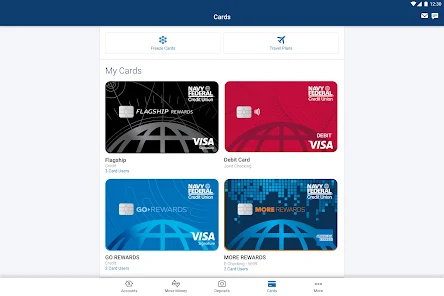

What is Navy Federal Credit Union Navy Federal Credit Union is a credit union that serves members of the United States Armed Forces, Department of Defense, and their families. The credit union was founded in 1933 and is headquartered in Vienna, Virginia. Navy Federal Credit Union offers a range of financial products and services, including checking and savings accounts, loans, credit cards, and investment services. The credit union is known for its competitive rates and its commitment to serving the financial needs of military members and their families. Features of Navy Federal Credit Union Navy Federal Credit Union offers a range of features and benefits to its members, including: 1、Competitive rates: Navy Federal Credit Union offers competitive rates on its financial products and services, including low interest rates on loans and credit cards, and high interest rates on savings accounts. 2、Personalized service: Navy Federal Credit Union has a team of dedicated representatives who provide personalized assistance to members, including help with account management and financial planning. 3、Convenient access: Navy Federal Credit Union has over 300 branches and over 1,000 ATMs nationwide, as well as online and mobile banking services, so members can access their accounts and manage their finances wherever they are. 4、Exclusive discounts: Navy Federal Credit Union offers exclusive discounts and perks to its members, such as waived fees, special rates, and rewards programs. 5、Military support: As a credit union that serves members of the military and their families, Navy Federal Credit Union provides specialized services and support to its members, such as deployment support and financial education. How to use Navy Federal Credit Union To use Navy Federal Credit Union, you must first become a member. To join, you must be an active or retired member of the United States Armed Forces, Department of Defense, or a family member of someone who is eligible to join. Once you have joined, you can access Navy Federal Credit Union's services through a variety of channels, including online banking, mobile banking, and in-person at one of the credit union's branches. To access Navy Federal Credit Union's online banking services, you will need to visit the credit union's website and create an online account. Once you have an online account, you can log in to view your accounts, transfer funds, pay bills, and more. To access Navy Federal Credit Union's mobile banking services, you will need to download the credit union's mobile app from the App Store or Google Play. Once you have the app, you can log in with the same username and password you use for online banking to access your accounts and manage your finances on the go. To visit a Navy Federal Credit Union branch in person, you can use the credit union's branch locator tool on its website to find a branch near you. You can then visit the branch during normal business hours to speak with a representative, open a new account, or conduct other transactions. Pros & Cons The main advantage of using Navy Federal Credit Union is that it offers competitive rates and a range of financial products and services specifically designed to meet the needs of military members and their families. The credit union is known for its commitment to serving the financial needs of its members and for providing excellent customer service. Additionally, Navy Federal Credit Union has a strong track record of financial stability and security, so members can trust that their money is in good hands. However, there are also some potential disadvantages to using Navy Federal Credit Union. One potential issue is that the credit union is only available to members of the United States Armed Forces, Department of Defense, and their families. This means that not everyone is eligible to join and access the credit union's services. Additionally, the credit union may not have as many branches or ATMs as some larger banks, so members who need access to in-person services may have to travel to access them. Finally, the credit union may not offer as wide a range of products and services as some larger banks, so members with very specific financial needs may not be able to find a suitable product from Navy Federal Credit Union.

Similar Apps

Top Apps